-

Creative

-

SphereSeries

Customized

More

SphereSeries

Customized

More

-

CubeSeries

Customized

More

CubeSeries

Customized

More

-

CircleSeries

Customize

More

CircleSeries

Customize

More

-

FootballSeries

Customize

More

FootballSeries

Customize

More

-

WingSeries

Customize

More

WingSeries

Customize

More

-

Umbrella-shapeSeries

Customize

More

Umbrella-shapeSeries

Customize

More

-

Face-shapedSeries

Customize

More

Face-shapedSeries

Customize

More

-

Ribbon-ShapedSeries

Customize

More

Ribbon-ShapedSeries

Customize

More

-

Water Drop-shapedSeries

Customize

More

Water Drop-shapedSeries

Customize

More

-

-

LED Display

-

IFSeries

Indoor Fixed

More

IFSeries

Indoor Fixed

More

-

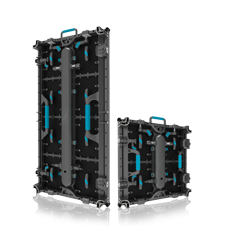

BMSeries

640x480mm

More

BMSeries

640x480mm

More

-

QSSeries

More

QSSeries

More

-

Wall PROSeries

1000/750/500x250mm/1000x500mm

More

Wall PROSeries

1000/750/500x250mm/1000x500mm

More

-

BM ProSeries

640x480mm

More

BM ProSeries

640x480mm

More

-

FASeries

Front Access & Back Access

More

FASeries

Front Access & Back Access

More

-

OFSeries

Outdoor Fixed

More

OFSeries

Outdoor Fixed

More

-

FSSeries

960x960mm

More

FSSeries

960x960mm

More

-

STSeries

1000x500mm

More

STSeries

1000x500mm

More

-

LKSeries

820x1830mm

More

LKSeries

820x1830mm

More

-

CornerSeries

More

CornerSeries

More

-

FMSeries

1000x1000mm

More

FMSeries

1000x1000mm

More

-

FS PROSeries

960x960mm

More

FS PROSeries

960x960mm

More

-

FM PROSeries

800x900mm, 800x1200mm

More

FM PROSeries

800x900mm, 800x1200mm

More

-

OFRSeries

Outdoor Fixed

More

OFRSeries

Outdoor Fixed

More

-

XTSeries

X -- 500x500x80mm T-- 500x1000x80mm

More

XTSeries

X -- 500x500x80mm T-- 500x1000x80mm

More

-

TSeries

500x1000mm

More

TSeries

500x1000mm

More

-

V & HSeries

V -- 500x500mm H -- 500x1000mm

More

V & HSeries

V -- 500x500mm H -- 500x1000mm

More

-

S & KSeries

500x500mm, 500x1000mm

More

S & KSeries

500x500mm, 500x1000mm

More

-

L&F PROSeries

L Pro -- 500x500mm F Pro -- 500x1000mm

More

L&F PROSeries

L Pro -- 500x500mm F Pro -- 500x1000mm

More

-

MSeries

500x500mm

More

MSeries

500x500mm

More

-

TGC-RSeries

500x1000mm

More

TGC-RSeries

500x1000mm

More

-

L-COB1.9Outdoor

500x500mm

More

L-COB1.9Outdoor

500x500mm

More

-

COBSeries

600x337.5mm

More

COBSeries

600x337.5mm

More

-

HDSeries

400x300mm

More

HDSeries

400x300mm

More

-

CLSeries

500x500mm

More

CLSeries

500x500mm

More

-

U ProSeries

600x337.5x27.5mm

More

U ProSeries

600x337.5x27.5mm

More

-

PMSeries

960x960mm

More

PMSeries

960x960mm

More

-

PM PLUSSeries

1600 x 900 x 98mm

More

PM PLUSSeries

1600 x 900 x 98mm

More

-

TGCSeries

1000x500mm

More

TGCSeries

1000x500mm

More

-

TGCGuide

More

TGCGuide

More

-

TPosterSeries

1000 X 2000mm

More

TPosterSeries

1000 X 2000mm

More

-

ASeries

816x384mm/800x400mm

More

ASeries

816x384mm/800x400mm

More

-

FloorSeries

500x1000mm

More

FloorSeries

500x1000mm

More

-

FLOOR PLUSSeries

500x500mm

More

FLOOR PLUSSeries

500x500mm

More

-

Floor RSeries

500x500mm

More

Floor RSeries

500x500mm

More

-

FlexSeries

Customized

More

FlexSeries

Customized

More

-

FLEX ColumnSeries

Customized

More

FLEX ColumnSeries

Customized

More

-

SPosterSeries

Customized

More

SPosterSeries

Customized

More

-

-

Markets & Solution

- Advertising Media DOOH Glass Wall Billboard Architecture

- Rental Stage Event Entertainment Concert Exhibition

- Control Room Broadcasting Studio Conference

- Football Soccer Basketball Baseball Hockey

- Retail Property Shopping Mall Street Commercial

- Religion House for Worship Church Auditorium

- Cylinder Round Ring Square Column Rectangle 90°

- Cloud Cluster 4G WiFi USB APP Control

- Front magnet Front Open Double Sided Front Installation

- How to Install LED Display with Structure Frame

- Sphere Cube Triangle Ceiling Tunnel Creative

- LEDFUL Naked Eye 3D -- DOOH New Style

- LEDFUL BEVEL Series Makes More Possibilities

- LEDFUL Taxi Top Bus Cars Vehicle Advertising LED Display

-

Advertising Media DOOH Glass Wall Billboard Architecture

More

Advertising Media DOOH Glass Wall Billboard Architecture

More

-

Rental Stage Event Entertainment Concert Exhibition

More

Rental Stage Event Entertainment Concert Exhibition

More

-

Control Room Broadcasting Studio Conference

More

Control Room Broadcasting Studio Conference

More

-

Football Soccer Basketball Baseball Hockey

More

Football Soccer Basketball Baseball Hockey

More

-

Retail Property Shopping Mall Street Commercial

More

Retail Property Shopping Mall Street Commercial

More

-

Religion House for Worship Church Auditorium

More

Religion House for Worship Church Auditorium

More

-

Cylinder Round Ring Square Column Rectangle 90°

More

Cylinder Round Ring Square Column Rectangle 90°

More

-

Cloud Cluster 4G WiFi USB APP Control

More

Cloud Cluster 4G WiFi USB APP Control

More

-

Front magnet Front Open Double Sided Front Installation

More

Front magnet Front Open Double Sided Front Installation

More

-

How to Install LED Display with Structure Frame

More

How to Install LED Display with Structure Frame

More

-

Sphere Cube Triangle Ceiling Tunnel Creative

More

Sphere Cube Triangle Ceiling Tunnel Creative

More

-

LEDFUL Naked Eye 3D -- DOOH New Style

More

LEDFUL Naked Eye 3D -- DOOH New Style

More

-

LEDFUL BEVEL Series Makes More Possibilities

More

LEDFUL BEVEL Series Makes More Possibilities

More

-

LEDFUL Taxi Top Bus Cars Vehicle Advertising LED Display

More

LEDFUL Taxi Top Bus Cars Vehicle Advertising LED Display

More

- Project

- News

- About

- Support

-

Contact

- CLOUD